Quick recovery after recession leads to promising economic outlook for state

The economic outlook for Arizona and the U.S. is promising as the deep recession sparked by the pandemic quickly recedes, according to three Arizona State University experts.

“A year ago, we were wondering how deep it would be and how long it would last,” Dennis Hoffman said of the economic downturn brought on by COVID-19.

“Now we know: It was very deep but it was very short-lived."

Hoffman, director of the L. William Seidman Research Institute in the W. P. Carey School of Business, spoke at the annual economic forecast event held by the Economic Club of Phoenix, a unit of the W. P. Carey School. The panel discussion was held online Thursday.

The federal government’s economic stimulus checks are a big factor in the recovery, Hoffman said.

“The stimulus data are amazing. Without a stimulus, there would be a deep decline,” he said. “But the forecasters are clear: It’s onward and upward from here. There’s not a lot of debate around that.”

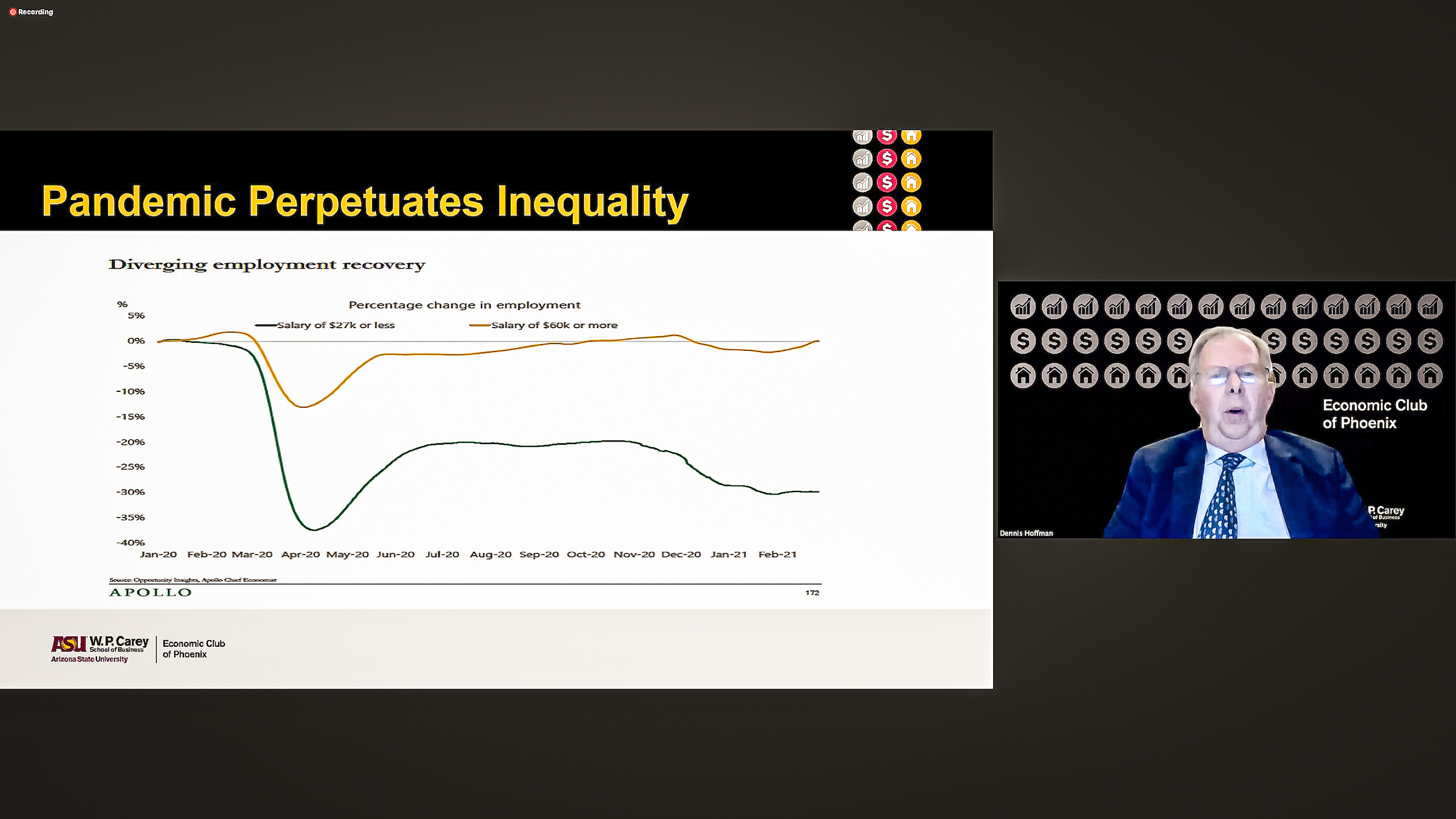

However, Hoffman noted that the recovery has not been equal for everyone.

“During the recovery, the folks making $60,000 or more had a blip and are now back to normal, but for those making $27,000, they are still well below where they were before the pandemic,” Hoffman said.

Dennis Hoffman, professor of economics and director of the L. William Seidman Research Institute at ASU, showed a slide that illustrated how the pandemic recovery has exacerbated income inequality. People earning $60,000 or more are doing as well as before the pandemic, while those who earn $27,000 or less are faring much worse. Screenshot by Charlie Leight/ASU News

Hoffman said that some are worried about inflation.

“Many companies are planning to raise prices. Food prices are up. Transportation costs are up. Lumber prices are through the roof,” he said.

“The Fed sees only a temporary price pressure, but no ongoing inflation.”

A quick recovery for Phoenix and the state

The outlook for Arizona and the Phoenix metro region also is good, according to Lee McPheters, research professor of economics in the W. P. Carey School of Business and director of the school’s JPMorgan Chase Economic Outlook Center.

“Arizona went into the pandemic with a rip-roaring economy. We were No. 1 in the country in the rate of job creation,” he said.

“We expect over 115,000 jobs to be added this year, which will replace all the jobs that were lost by the end of 2021.”

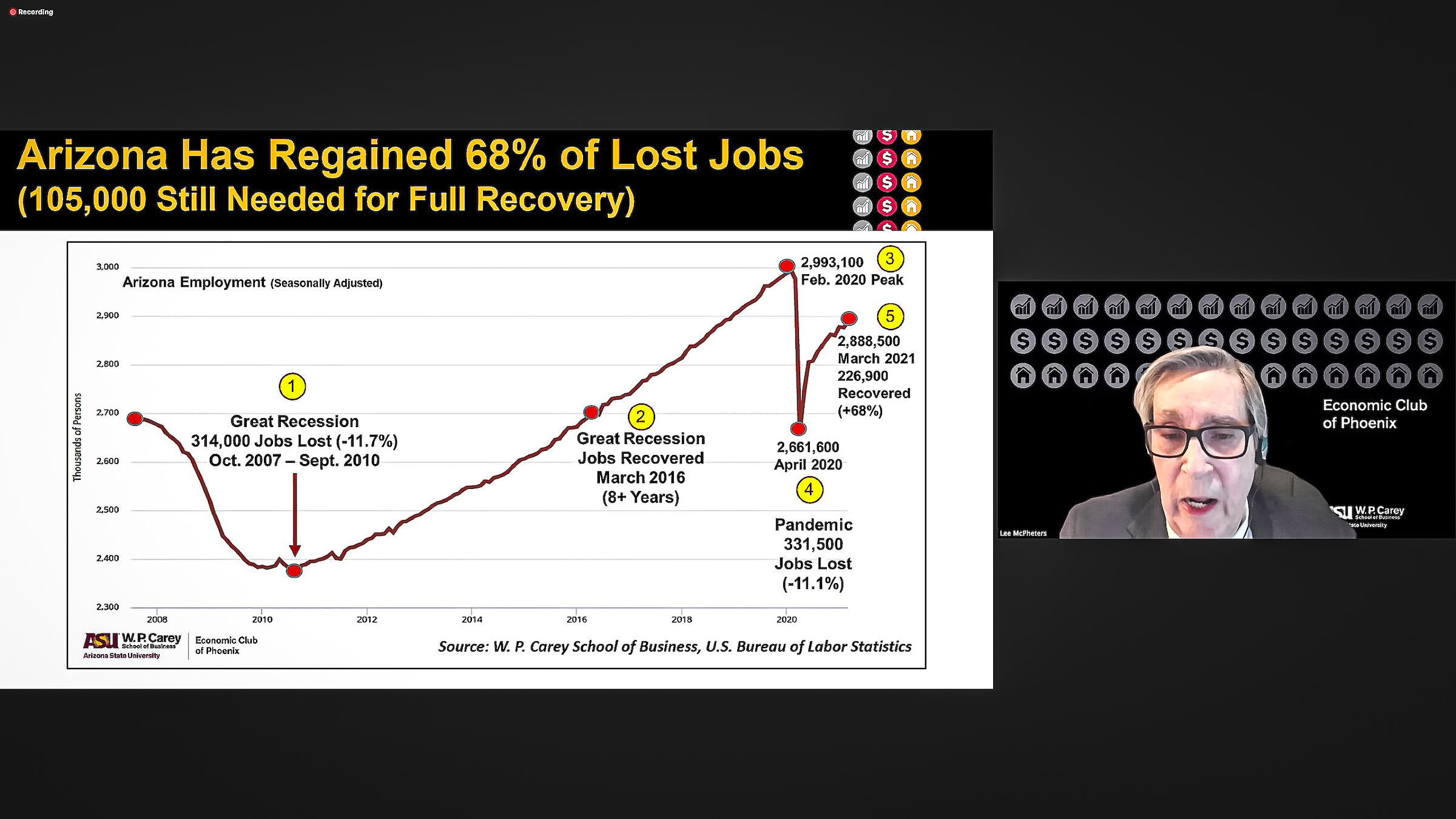

He compared the pandemic recession to the Great Recession of 2007–10.

“The Great Recession lost over 300,000 jobs in three years and took five years to recover them,” he said.

The current recession started in April 2020.

“We lost over 331,000 jobs, more than the Great Recession, but we’ve already recovered over two-thirds,” he said.

Lee McPheters, research professor of economics and director of the JPMorgan Chase Economic Outlook Center at ASU, showed a slide illustrating the slow recovery from the Great Recession and the deep but brief recession sparked by the COVID-19 pandemic. Screenshot by Charlie Leight/ASU News

Arizona has always depended on migration to the state to drive economic development, McPheters said.

Analysts were shocked when the recent census results showed that Arizona added 774,000 people over the previous decade, and not the million new residents that were expected.

“The big issue for economists is that a lot of government money is distributed on a per-capita basis, and those dollars won’t be going to Arizona,” he said.

While in previous years, construction was the No. 1 growth industry in the Phoenix metro area, right now it’s transportation and warehousing.

“Over 60 million square feet of industrial space is under construction,” he said. “Amazon has signed 11 leases last year alone.”

One exception to the bright outlook is for small businesses, about 30% of which remain closed, McPheters said.

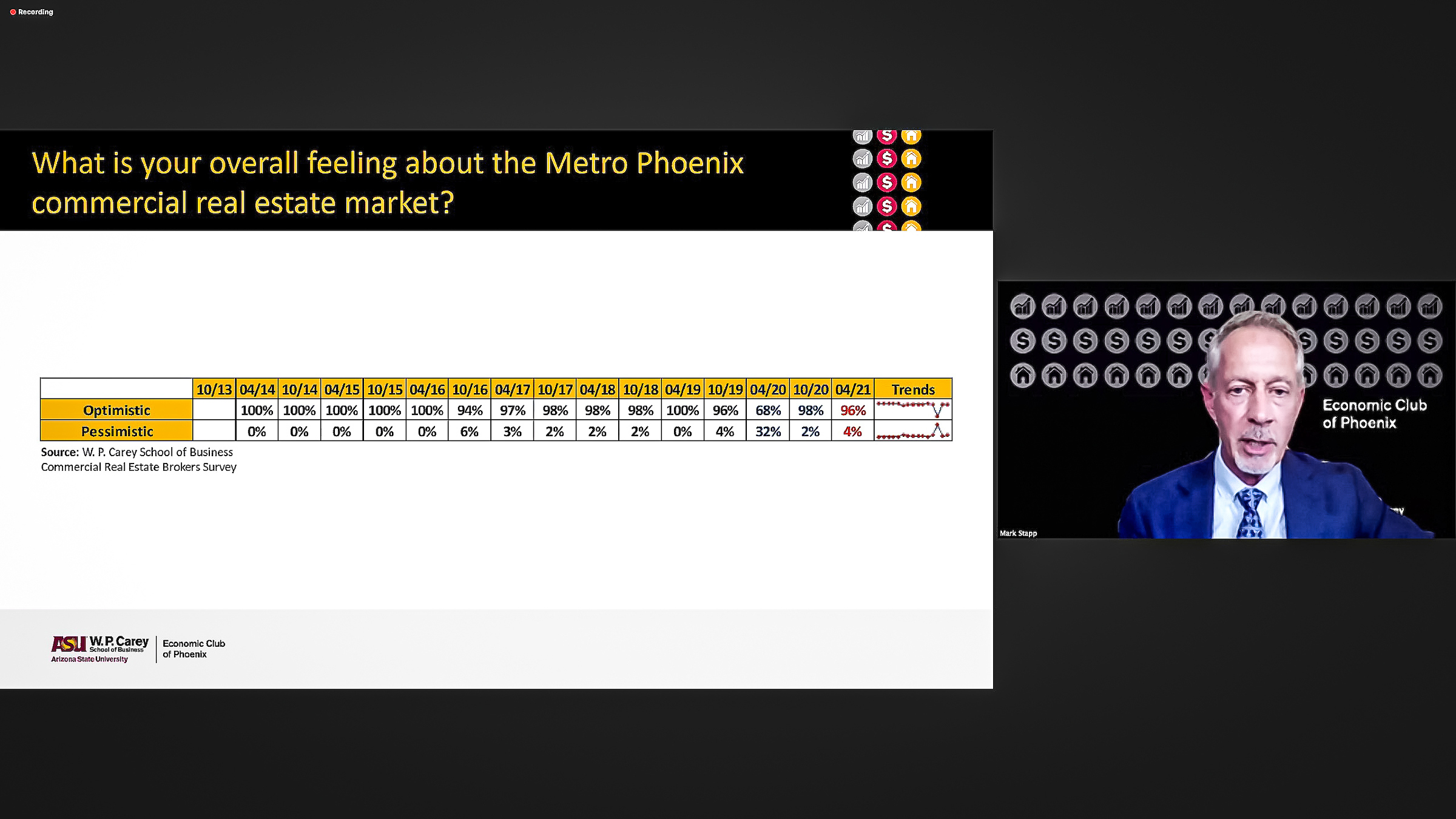

With real estate, experts are now starting to realize which changes wrought by the pandemic will last, according to Mark Stapp, the Fred E. Taylor Professor of Real Estate in W. P. Carey. Among those:

- Retail was already being reimagined, but those changes are occurring more rapidly, such as a focus on “experiential retail” and health and wellness. “Retailers want to change what they’re using the brick-and-mortar spaces for, and that will change the value proposition for those spaces.”

- The “work from anywhere” movement is here to stay. “The cost of making office spaces comfortable for employees to return is having a big impact on net operating income and affecting the value of the spaces as well.”

- Industrial spaces are thriving. “For fulfillment and logistics, we are the place to be.”

Mark Stapp, the Fred E. Taylor Professor in Real Estate at ASU, showed a slide illustrating the results of a recent survey of commercial real estate agents, showing that 96% are optimistic about the market in Phoenix. Screenshot by Charlie Leight/ASU News

Is there a housing bubble?

ASU’s experts say that there is no housing “bubble” that could burst, leading to an economic freefall like the one in the previous decade.

McPheters said that economic development depends on the supply and affordability of housing.

“Home prices are up about 24% over a year ago,” he said.

But compared with California and other places that people are leaving to move to Arizona, the local housing is affordable.

“Even though home prices are up, incomes also are up and mortgage rates are down, so mortgage payments are not in the ‘bubble’ territory yet,” McPheters said.

Stapp said that there are simply not enough houses because the market was underbuilt over the previous decade, while the population was growing.

“We have a supply problem, and that’s not easy to fix,” he said.

“From 2011 onward, it was consuming overbuilt inventory. By 2015, we had consumed most of that and continued to build at very low rates,” Stapp said.

“It’s not a problem as long as we have better wage-earning jobs moving here and as long as interest rates stay low.”

But income inequality could be a risk factor.

“The social concern is that there are winners and losers, and we have to focus on the losers just as much as the winners,” he said.

“It will create a drag on the economy if we don’t pay close attention to it.”

Top photo of downtown Phoenix by Deanna Dent/ASU News

More Business and entrepreneurship

New ASU certificate to address veteran underemployment

Veterans and military spouses bring a wealth of talent to the corporate world. Unfortunately, human resources and hiring managers without military backgrounds often struggle to understand…

ASU China Executive MBA ranked No. 7 in world by Financial Times

In the 2024 Financial Times rankings for Executive MBA (EMBA) programs, Arizona State University's W. P. Carey School of Business China Executive MBA program ranked No. 7 in the world, ahead of the…

ASU, Ghana partnership enhances supply chain practices in Africa

As a New American University, ASU defines the communities it serves as including both its backyard neighbors and colleagues around the world. For the past four years, Arizona State University…