ASU experts see huge economic dropoff from pandemic, then rapid recovery

Despite almost unfathomable numbers of job losses, experts at Arizona State University are predicting that economic recovery from the COVID-19 pandemic could be rapid. However, our radically changed lifestyles could produce lingering effects.

The professors emphasized the unique nature of the speedy economic downturn over the last six weeks, since Americans were told to stay home, and the lack of data to make unqualified forecasts.

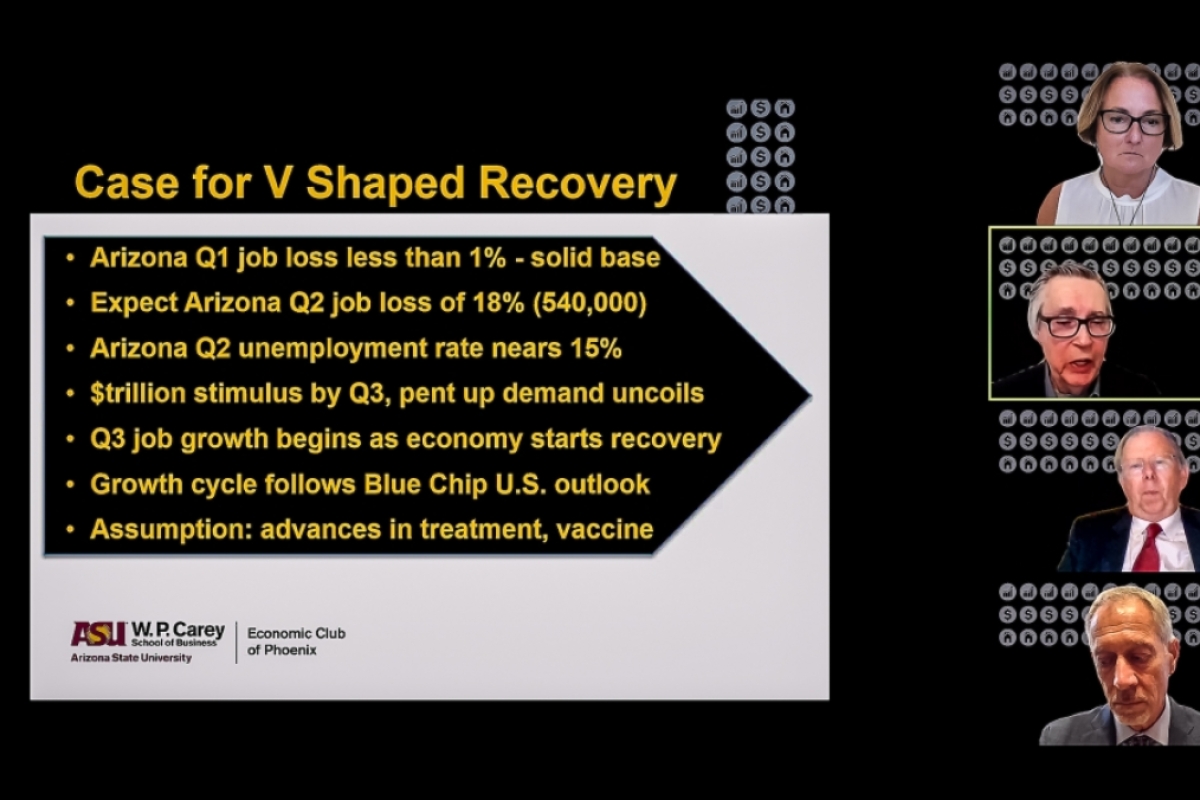

“What most analysts see is a growth cycle of a strong third and fourth quarter, if there are advances in treatment and possibly a vaccine development for the virus,” said Lee McPheters, Research Professor of Economics in the W. P. Carey School of Business at ASU and director of the school’s JPMorgan Chase Economic Outlook Center. He spoke at the annual economic forecast event held by the Economic Club of Phoenix, a unit of W. P. Carey. The panel discussion was held online Tuesday.

Economists are predicting various scenarios, including a V-shaped, U-shaped, L-shaped or W-shaped recession, according to Dennis Hoffman, an economist and the director of the L. William Seidman Research Institute at the W. P. Carey School.

“Some see a V-shaped scenario where the second quarter is very, very deep but immediately followed by a strong rebound,” Hoffman said.

“A U-shaped scenario lasts several quarters but once the economy gains its footing, it rebounds rapidly. The key is to note that despite the different scenarios, at the end of 2021, we’re back pretty much to the same place.”

An L-shaped recession would last very long.

“An L is hard to imagine without extended versions of mutated viruses or no vaccine for years,” he said.

A W-shaped outlook would mean recovery followed by another recession if the virus comes back in the fall.

“That would mean we haven’t learned anything about this episode and frankly I find that difficult to envision,” he said.

Among the statistics the professors presented:

• Before the pandemic, Arizona was ranked third in the nation in population growth and job growth, and our wage increase of 4.4% outpaced the national rate of 3%.

• Nationwide, job losses from the pandemic are predicted to be between 22 million and 27 million. “These numbers are so staggering that we can’t think of them as permanent job losses,” Hoffman said. “They’ll be quite temporary.”

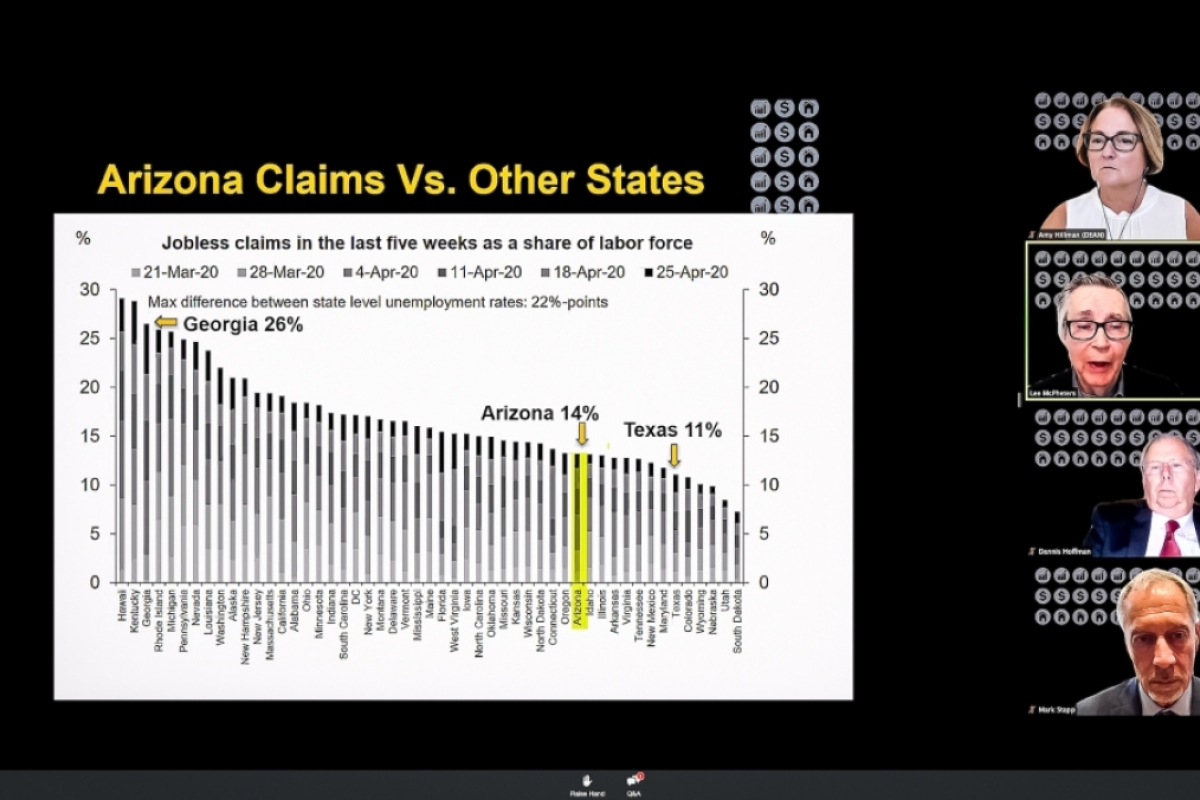

• Arizona’s 475,000 unemployment claims represent 14% of the labor force, with tourism, health care and retail hit hardest. McPheters expects Arizona’s job loss to hit 540,000.

• A survey of Phoenix-area real estate brokers in April found that 32% were pessimistic about the real estate market, and 46% felt the market is moving down.

• Local First AZ has distributed more than $364,000 to help keep nearly 200 small businesses afloat since March 25, but more than 1,400 businesses that applied did not receive funds.

In Arizona, the current downturn is very different from the Great Recession of a decade ago in one significant way, McPheters said. Health care actually expanded during the recession, adding 30,000 jobs, while that industry lost 300,000 jobs recently.

The long-term economic effects in the Valley could depend on the largest occupations: customer service, 79,000 jobs; retail, 68,000; food prep and food service, 44,000; cashier, 44,000; managers, 38,000; registered nurses, 38,000; office workers, 36,000, and personal care aides, 36,000.

“What this looks like is a list of occupations and industries where there is a very high risk of disease transmissions,” McPheters said.

“Customer service reps is an area where there are a lot of call centers, and while not as severe as meat-packing, call centers, because of the way they’re set up, have had problems with disease transmission.”

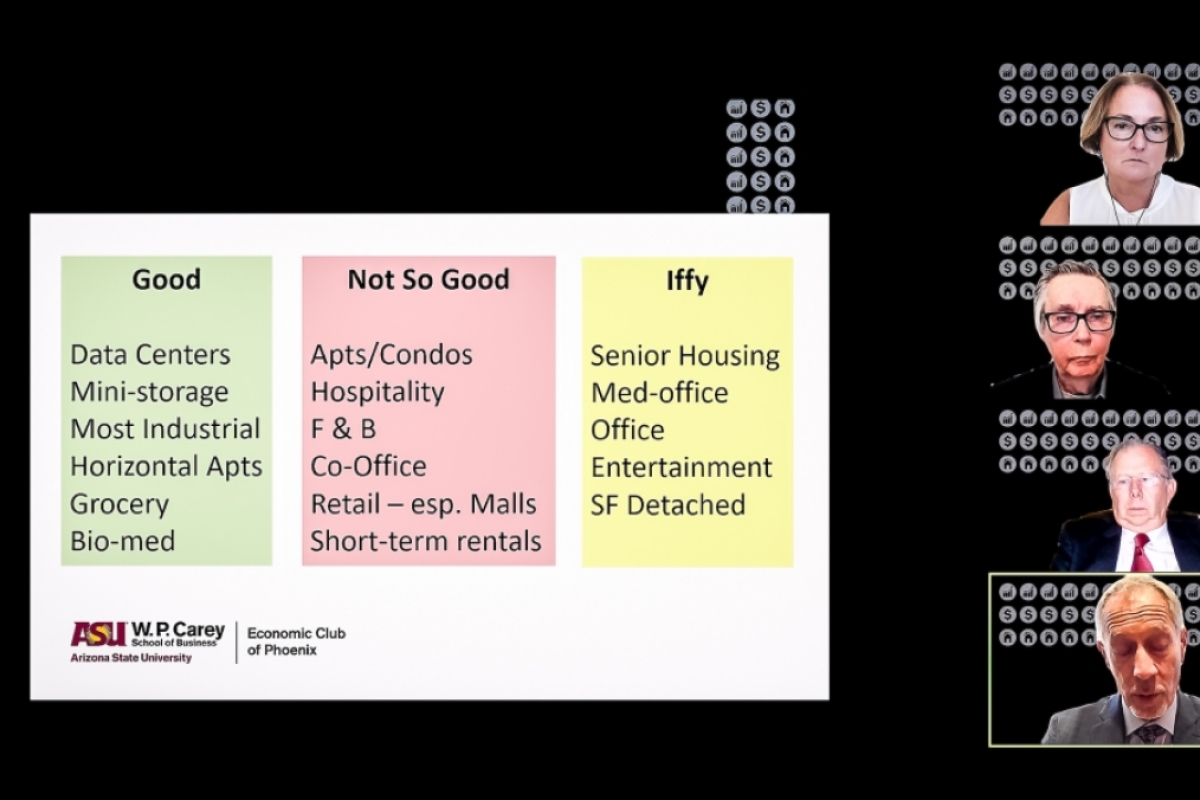

Forecasting is especially difficult for real estate, according to Mark Stapp, the Fred E. Taylor Professor in Real Estate in the W. P. Carey School of Business.

“Most data we look at is 30 days backward-looking, and because we’ve only been in this six weeks or so, it’s hard to make those predictions,” he said.

Nationwide surveys show mixed results for single-family home selling: Interest in home buying is down slightly, but sellers are not budging in prices.

In terms of real estate investing, times are good for people who put money into data centers, mini-storage units, grocery stores and biomedical facilities. The outlook is poor for investment in apartments, hospitality, malls and units used for short-term rentals, like AirBnb, he said.

Stapp noted that the National Restaurant Association reported that nationwide, 14% of restaurants expect to close permanently because of the pandemic.

“That’s huge for us because we have become a foodie place, and chef-driven restaurants and local concepts were a big part of our character,” he said.

“It wasn’t ‘Who’s your major tenant?’ It was, ‘What’s your food lineup?’”

Changes in human behavior related to the outbreak could have economic consequences. For example, large office buildings will likely need to spend more money on cleaning and possibly on renovations to keep office workers farther apart, Stapp said.

“Right now the average is about 100 square foot per employee, and that will likely jump up as we have social distancing,” he said. “That will reduce the utility of the space and that reduces the amount of rent.”

Hoffman said that one survey showed that 51% of people said they wanted to continue working from home when the shutdown is over.

Then there’s the fear factor.

“Will preferences for senior living facilities be permanently altered? Nobody wants to get on an airplane,” Hoffman said.

“Will urban centers lose some of their luster? Will we get foodie islands in Queen Creek, Casa Grande or Surprise? Businesses will have to face some significant decisions based on what you think the answers to those questions are.”

The crisis could be an opportunity for the Valley to rebrand itself as “the healthiest metro area” because of several factors, including an outdoor lifestyle, low density, low reliance on public transportation and low interest rates, Stapp said.

“We’re a new and young metro area, which means we can easily adapt,” he said.

“We’re going to find ingenuity and creativity, and we know we’ll need compassion.”

Top image of Phoenix by Deanna Dent/ASU Now

More Business and entrepreneurship

New rankings show impact of ASU W. P. Carey School of Business

Good rankings for Arizona State University's W. P. Carey School of Business reinforces the school's commitments to access, excellence and innovation.This week, the Financial Times Business Education…

Arizona Business and Health Summit asks attendees to innovate for value

Arizona State University's W. P. Carey School of Business hosted the third annual Arizona Business and Health Summit, sponsored by the Arizona Biomedical Research Centre, on Thursday, Nov. 14, in…

An economic forecast with lots of variables

The prospect of a new presidential administration is prompting some discussions among top economists.Tariffs, immigration, possible deportation, tax cuts and reduced renewable energy credits are top…