ASU actuarial science students win 1st place in international case study competition

In another first for the excelling actuarial science program at Arizona State University, a team of four students took first place in the Society of Actuaries (SOA) Student Research Case Study Challenge. Now in its fifth year, the SOA challenge drew 68 teams from 32 universities around the world.

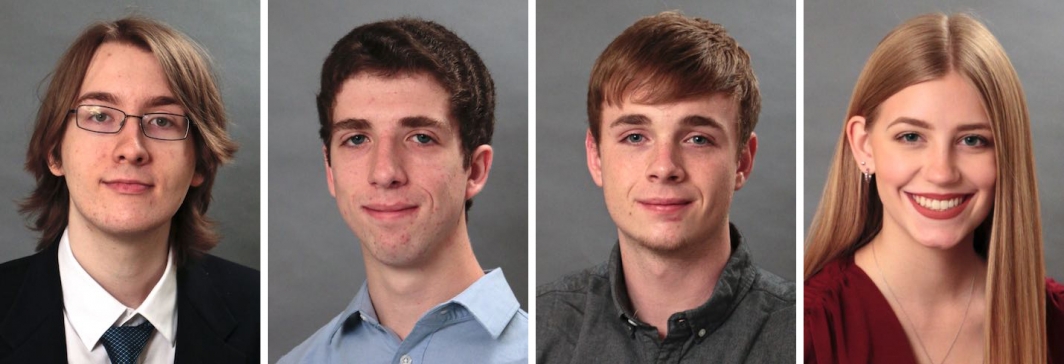

Team Emission: Impossible, this year’s first-place team, was made up of Joseph Hoffman, Brady Lybarger, Walker Reinmann and Kinsey Turk and was awarded a $5,000 grant for ASU, as well as $500 cash prizes for each student. Last year Team Pink, an all-female team of ASU actuarial students, placed third overall.

“Our team earning first place shows that Arizona State’s actuarial science program and its students are among the best in the nation,” said Al Boggess, director of the School of Mathematical and Statistical Sciences.

The SOA Student Research Case Study Challenge provides an opportunity for teams of students to apply their actuarial skills on a real-world problem. Over the course of eight weeks, teams research a case study situation, conduct actuarial analysis, develop solutions and complete a professional written report. Selected finalists then present their results to an international panel of judges.

This year, the challenge focused on designing a carbon credits program. A carbon credit is a government-issued permit that gives the holder, such as a company, the legal right to emit 1 metric ton of carbon dioxide or an equivalent amount of other greenhouse gases.

Student teams worked to help a fictitious country called Pullanta, which is economically developed with a population of about 20 million people. Pullanta’s government recently set a goal of reducing carbon emissions to 25% below the 2018 level by the end of the year 2030.

The teams were "hired" to design a carbon credit program for Pullanta, which encourages reducing carbon emissions and generates revenue to fund climate change mitigation, and to recommend a comprehensive implementation plan for their programs.

ASU's winning Team Emission: Impossible (from left): Joseph Hoffman, Brady Lybarger, Walker Reinmann and Kinsey Turk.

“We started by designing financial instruments that would guarantee emissions reach those goals over the next 10 years with relative certainty,” said Lybarger. “Then it just became a matter of building a program around these instruments and ironing out the kinks.”

“The data that we received for the case study was incredibly limited and left several assumptions to be made,” explained Turk. “This was challenging since we had no actuarial experience to base these assumptions on. Instead, we had to conduct rigorous research to arrive at our final findings.”

“At times we would implement something we thought would work, and then later find flaws," said Reinmann. “Working out how all our regulations and products would coincide was overall the most difficult part of this case study.”

A panel of international judges for the challenge was impressed by the exceptional innovation demonstrated by the teams while maintaining mathematically and actuarially sound principles in their analysis. The top teams also provided solid answers to the judges’ questions that showed they had thoroughly considered multiple approaches and had made thoughtful, well-considered decisions.

“Team Emission: Impossible, besides the routine actuarial analysis, realized the importance of providing the government with concrete recommendations on regulation,” said Russell Hendel, an adjunct faculty member at Towson University in Maryland. “While most teams realized that remedies to the emission problem had to be done by sector, Team Emission: Impossible also recommended a unique floating bond for sectors with unique challenges.”

“I liked Team Emission: Impossible’s ‘nearest neighbor’ methodology, where a comparison with attributes of several countries was used to derive the social cost of carbon development for the country in the case study,” said fellow judge Carlos Arocha, a managing partner of Arocha and Associates in Zurich, Switzerland.

The timing of the competition brought another unexpected challenge: the COVID-19 pandemic.

“Last year, the team could get together in person to practice and present the results to the online judges. However, this all changed to online this year due to COVID-19, and each of them had to get used to presenting virtually at home,” explained Hongjuan Zhou, professor of practice in actuarial science at ASU and faculty adviser to the team. “I am impressed by the team for their efforts and time devoted in the case study. It is an accomplishment to write a professional report and make an excellent presentation to experienced actuaries.”

Hoffman encouraged other students to participate in future challenges.

“I would definitely recommend the case study challenges to students. While the actuarial science program at ASU is very thorough in developing mathematical and analytical skills, it is important to develop non-mathematical skills such as the ability to manage projects, the ability to work in a team and the ability to invent creative solutions to realistic problems,” said Hoffman. “The case study gave us the opportunity to combine all of these skills, which I think has contributed greatly to our professional development.”

Students from Shenzhen University in China received second place with a $3,000 grant, and third place went to students from University of California, San Diego with a $2,000 grant.

ASU’s School of Mathematical and Statistical Sciences actuarial science program has been an important source of actuarial employees for insurance companies since 1994 and launched its Bachelor of Science degree in 2014. Last fall, a Master of Science in actuarial science degree was introduced. This program provides possibilities for the school to collaborate with the actuarial industry on research in areas such as predictive analytics, reserving and pricing.

More Science and technology

Digital crimes leave data trails; these students built a tool to help explain them

In a courtroom, truth often hinges on storytelling. But when that story involves hex values, file systems, packet captures or…

From traffic systems to trustworthy AI, ASU students are solving problems the world can’t ignore

How do you trust artificial intelligence when it doesn’t know what it doesn’t know? How do you safely move computing systems…

Did the ribosome begin as a parasite?

The ribosome is one of life’s most remarkable inventions — a tiny molecular machine inside every cell that turns genetic code…